A Comprehensive Guide To Build Mobile Wallet App And Make It Highly Secure

Updated 18 Aug 2023

12 Min

11325 Views

The world market of online payments is one of the most fast-growing. According to Statista, the revenue of global mobile payment market has increased from USD 450 billion to USD 780 billion, and experts predict the growth up to more than 1 trillion in 2019. So turning to mobile application development services to create a wallet can be a really good idea for your startup.

We want to offer you a few useful recommendations on how to develop mobile wallet app and what advantages it will bring to your business.

What industries can benefit from mobile wallet app

What is a mobile wallet and how does it work? In fact, a mobile wallet is the one type of payment services when the user sends and receives money using a mobile device. Also, it can store information about credit and debit cards, digital currencies, tickets, loyalty cards etc.

It may seem that this service is tightly connected with the financial area. It is partly true, but let's consider this issue from the other side and see what area can benefit from mobile payment app development:

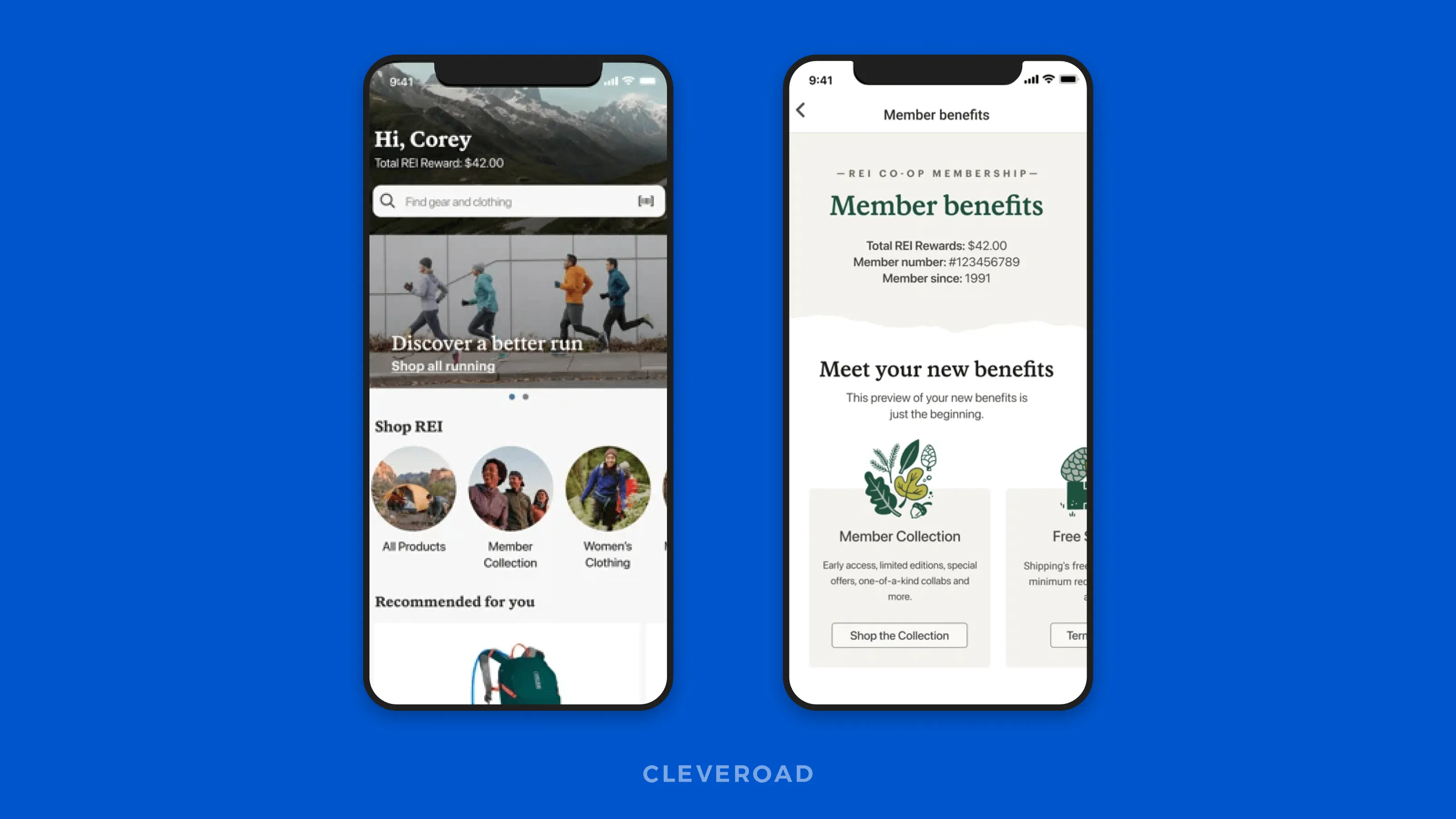

- Retail. It can be both an addition to the ready-made mobile app and solution for mobile commerce shop. Additional service allows users to store information about bargains as well as make payments in the form of coupons, loyalty cards, and bonuses. If you are considering [retail application development](internal:https://www.cleveroad.com/blog/retail-app-development--why-it-is-important-and-what-features-it-should-have/), but you don't what to start with, check it out this detailed guide.

Retail app as an example

- Financial establishments. They give users various cards like credit, debit cards, provide clients with services (for example, payment for public services with credit cards).

- Telecommunication companies, transportation, logistics, and technology companies that act as neutral players in the financial sector. They have more chances of integration of various payment cards from different banks in their mobile wallet.

If you have already decided to create a mobile wallet solution, you should determine what mobile wallet type you need. Features that will be included in the app will affect the final cost of the app development. For example, the app will have integrated offers about discounts and coupons only, or it will also have included payment feature, P2P payments, bills payment, tickets booking etc.

Types of mobile wallet

Types of e-wallets are different by models of payment processing. We will provide you with a few examples:

- Wallets that use mobile communication provider, so user sends and receives remittance with the help of a mobile operator;

- Wallets that write off funds using SMS message with a short code (funds write-off is performed usually from the banking account, credit card or mobile service);

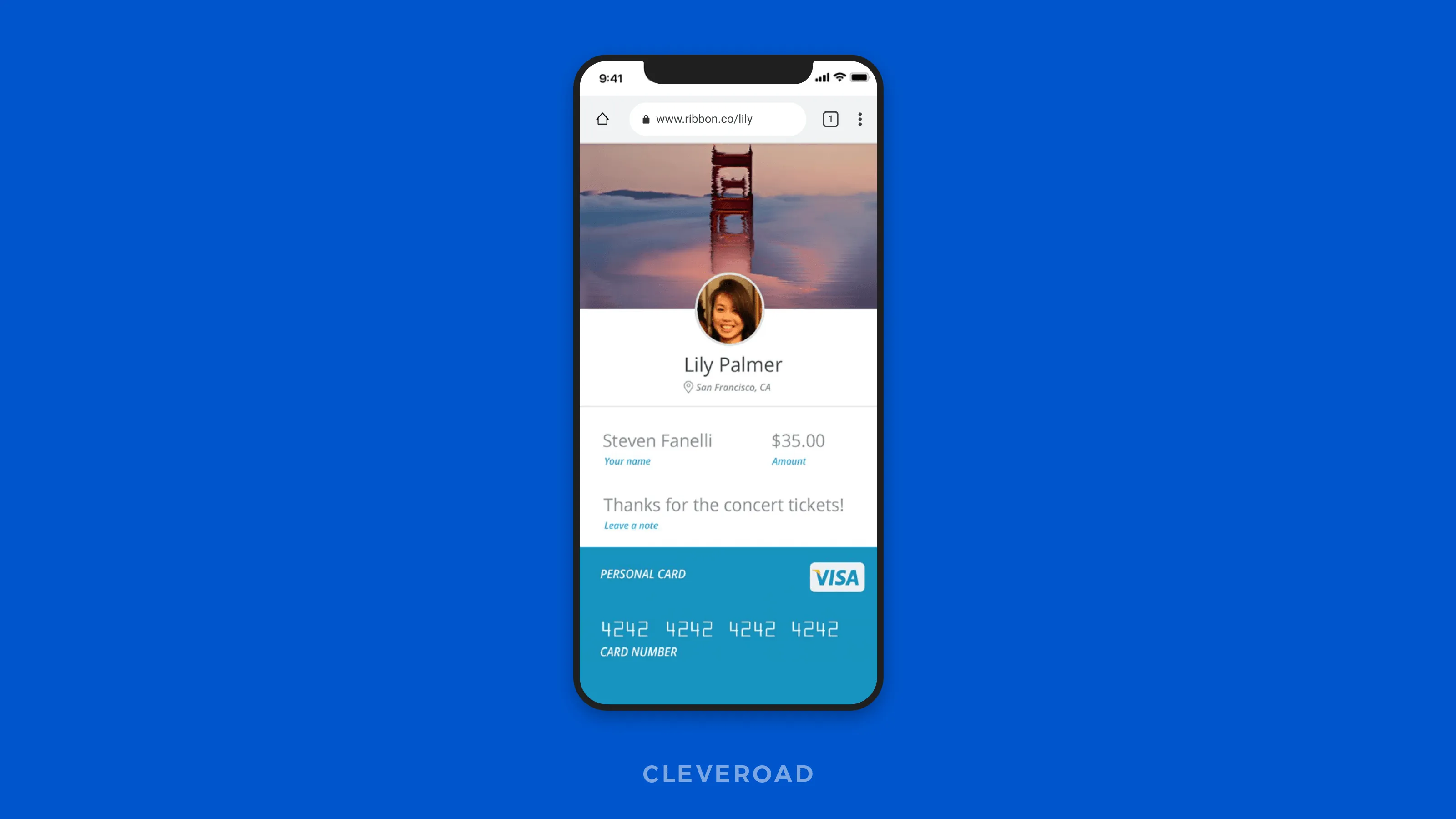

- Wallets that make mobile web payments (user sends and receives payments using the mobile app);

Make payments with a web-based wallet

- Wallets that use near field communication (NFC). This technology is working due to the mobile app and special equipment that is built into the smartphone for contactless interaction with the payment terminal.

You should note that a mobile wallet service is usually collaborating with the mobile communication service providers as well as with banks and other financial establishments.

Payment is the basis of the mobile wallet. Let's consider a typical case how mobile wallet works to determine what technologies you will need to create a high-quality service.

How mobile payment systems work

How to use wallet app? Users open the app and authorize using a PIN code, password, or a fingerprint scanner as an additional option. Then users choose card or banking account that was assigned to the app previously and plan to use this account for performing a current transaction. Then it is necessary to choose special offers or loyalty programs for clients to make use of. To achieve this goal, users should connect it to the payment terminal.

Do you know the right way how payment gateway should be integrated into your app? Watch our video to find out:

How to integrate a Payment Gateway into an App?

As a rule, mobile apps use NFC technology for transferring information about payments. Consequently, business owners need PoS system (Point of Sale) that supports NFC chip to receive payments from their smartphones. Besides that, different payment systems can be beneficial for your app. They are PayPal, Braintree, Stripe. Check out a comparison of payment gateways to choose the best one.

Why AI in FinTech can be a good advantage for your business. Read AI in FinTech: 5 proven ways how smart algorithms enhance financial processes

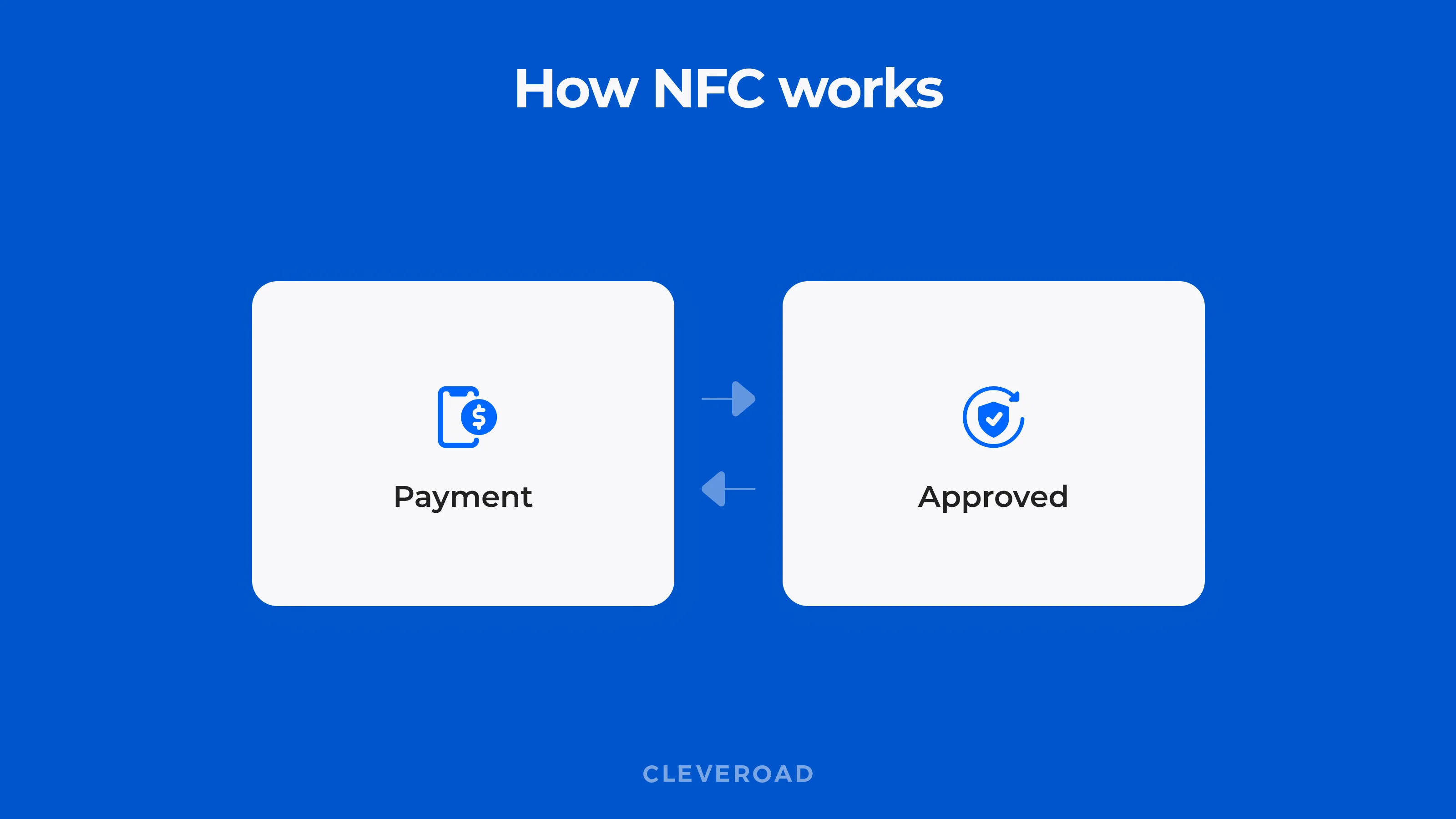

What is NFC technology?

You should learn more about this technology if you want to find out how to create a mobile payment app. It is a contactless remote technology that is functioning on the distance up to 10 cm and provides users with secure and contactless payments between smartphones and PoS-device. The technology works almost like Bluetooth, but NFC has one substantial advantage over Bluetooth - a shorter connection setup time. Unlike Bluetooth, NFC is connected immediately, less than for one-tenth of a second, and it is one of the best advantages of NFC technology.

NFC technology: principle of functioning

Three main NFC fields of application:

- card emulation: NFC device plays a role of a contactless card;

- reading mode: NFC device is active and it deciphers passive RFID tags;

- P2P mode: two NFC devices connect to each other and exchange information.

The advantage of this technology is a versatility. It is compatible with any contactless devices and RFID structures. Besides, technology will function even if one of the compatible devices has no power supply (switched-off phone, for example).

Technology is functioning in the following way: payment is made due to automatic payment information extraction from smartphone to the payment terminal. If the mobile wallet software supports host card emulation (HCE), the user needs to have the Internet connection to close the deal process.

NFC is already integrated into many devices. For example, starting with iPhone 6 and Apple Watch these devices support NFC and HCE technologies, but only for their own Apple Pay system.

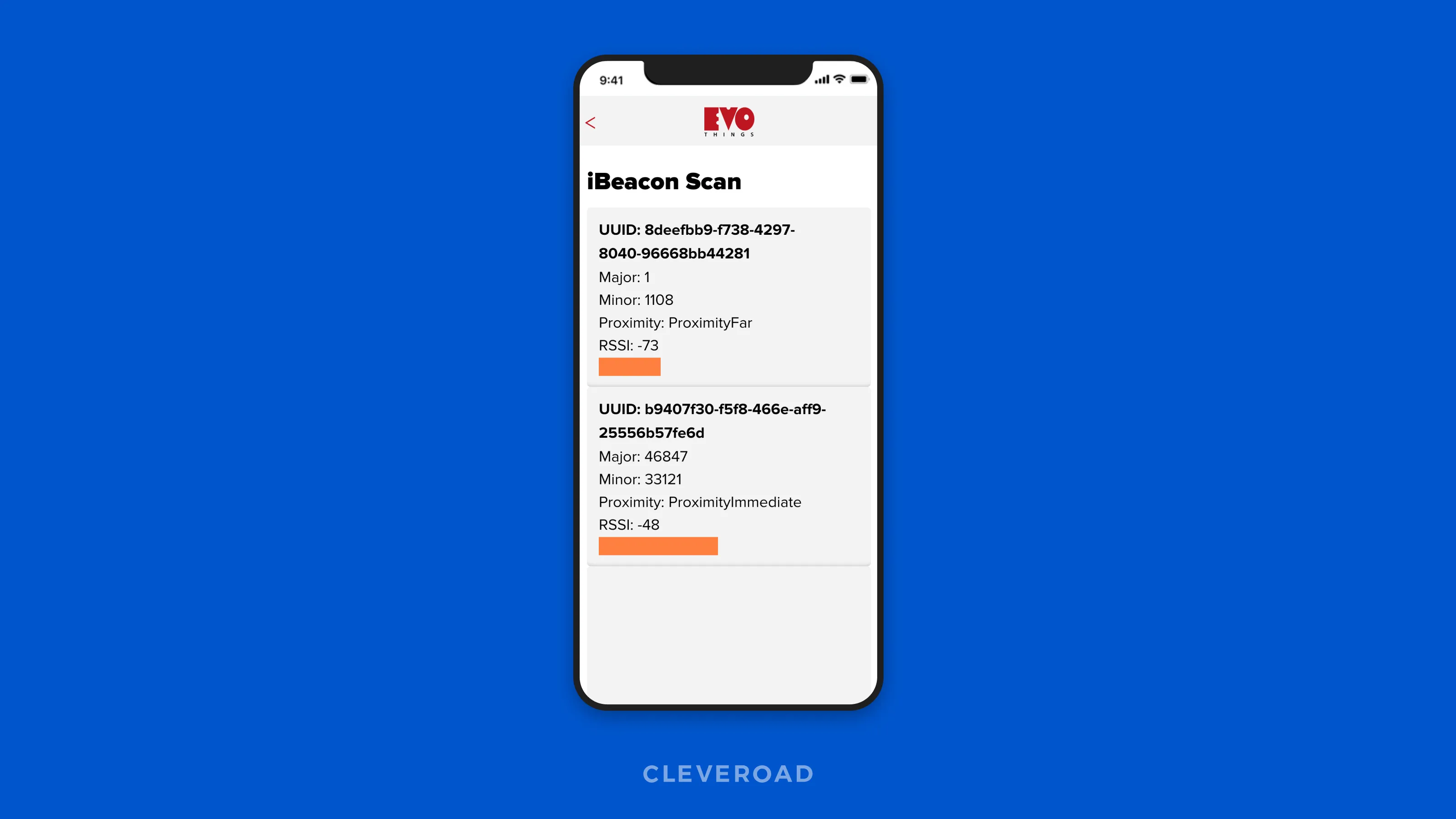

Apart from NFC technology, there are a few data transfer technologies can be used by mobile wallet systems, such as Bluetooth, iBeacon and QR codes.

Bluetooth and iBeacon technologies

iBeacon is the technology that allows including radio beacons in contactless data exchange with minimal power consumption. Devices uninterruptedly emit the signal received by smartphones that support BLE and located within the transmission range. The range is up to 70 meters in average.

iBeacon technology

Most smartphone models already support BLE so users will surely need to activate Bluetooth for receiving signals sent by radio beacons. iBeacon technology is compatible with the devices of any type whether it be iOS and Android. The main thing user needs to do is to activate Bluetooth. So benefits of mobile wallet are obvious.

Besides, iBeacon technology makes it possible to send personified offers about advertising campaigns, discount coupons etc to users when they are within the range of radio beacon activity. It can increase clients' interest while they are nearby your cinema, shop and so on. If you still hesitate and you are not sure whether you need beacons in your business, read about beacons and wearables technology in business.

QR codes

Using special services like QR generators that help encrypt required information and create a code, companies add images of generated QR code on forms of their receipts.

Customers usually want to pay for services using modern technologies like launching a corresponding app and scanning image on the invoice with the camera. Then they should see the code on their mobile app screen and make payment from their banking account. It is necessary to confirm this operation entering the password. Receipt of payment is sent to client's e-mail, and this is one of the ways how to use a mobile wallet securely.

QR code sample: how it looks

In addition, due to services like PayPal, PayQR, etc. clients make purchases in shops. If there is a QR scanner or barcode scanner in the outlet, then, upon app activation buyer brings the mobile device to such scanner and makes a payment. The amount is automatically written off from the mobile wallet application. If there is no such scanner, then the user will need to enter generated code via the POS-terminal keyboard.

Check out how FinTech software development services influence the future of various industries?

Note: when you make your decision to find out how to make a mobile wallet, you should remember that majority of smartphones already have relevant features that will simplify the integration of mobile wallet, such as:

- Camera (for QR code scanning);

- Bluetooth (for data transmission);

- GPS for positioning;

- Fingerprint scanning for users authentication;

- Internet connection for working with mobile wallet in the real-time mode.

Your mobile wallet will be tightly connected with all listed tools since they are involved in the payment and authentication process and should make a wallet more secure. So, if you still thinking about how to create a banking app and its security system, let's move on!

Why mobile wallet security matters

There is also one more important component that you should consider when you make wallet app. It is security. Nobody wants to have his or her money stolen. So let us see what can make such service safe.

Point-to-point encryption (P2PE)

This is an advanced and robust security tool that protects the whole transaction from the beginning to the end. It starts encrypting the transaction when you swipe your phone over PoS-terminal, then funds are in transit, and up to the authorization. This type of protection is included in the list of must-have security features your mobile wallet payment gateway should have.

Tokenization

Tokenization is a technology that makes e-payments secure with the help of reliable data encryption system. The buyer doesn't give seller his or her payment details paying by a card. All card information is encrypted and it is turned into a so-called token that looks like random symbols combination.

Password

Of course, a password is the type of protection any app or website that contains personal protection should have. It is better to add rejection feature if the customer creates too simple or too short password. It will help you increase the protection level and make a wallet more secure.

Optionally, additional biometric protection support can be added. If a smartphone of the user is advanced enough and it has a fingerprint scanner, your mobile wallet app may require the authorization using biometric data.

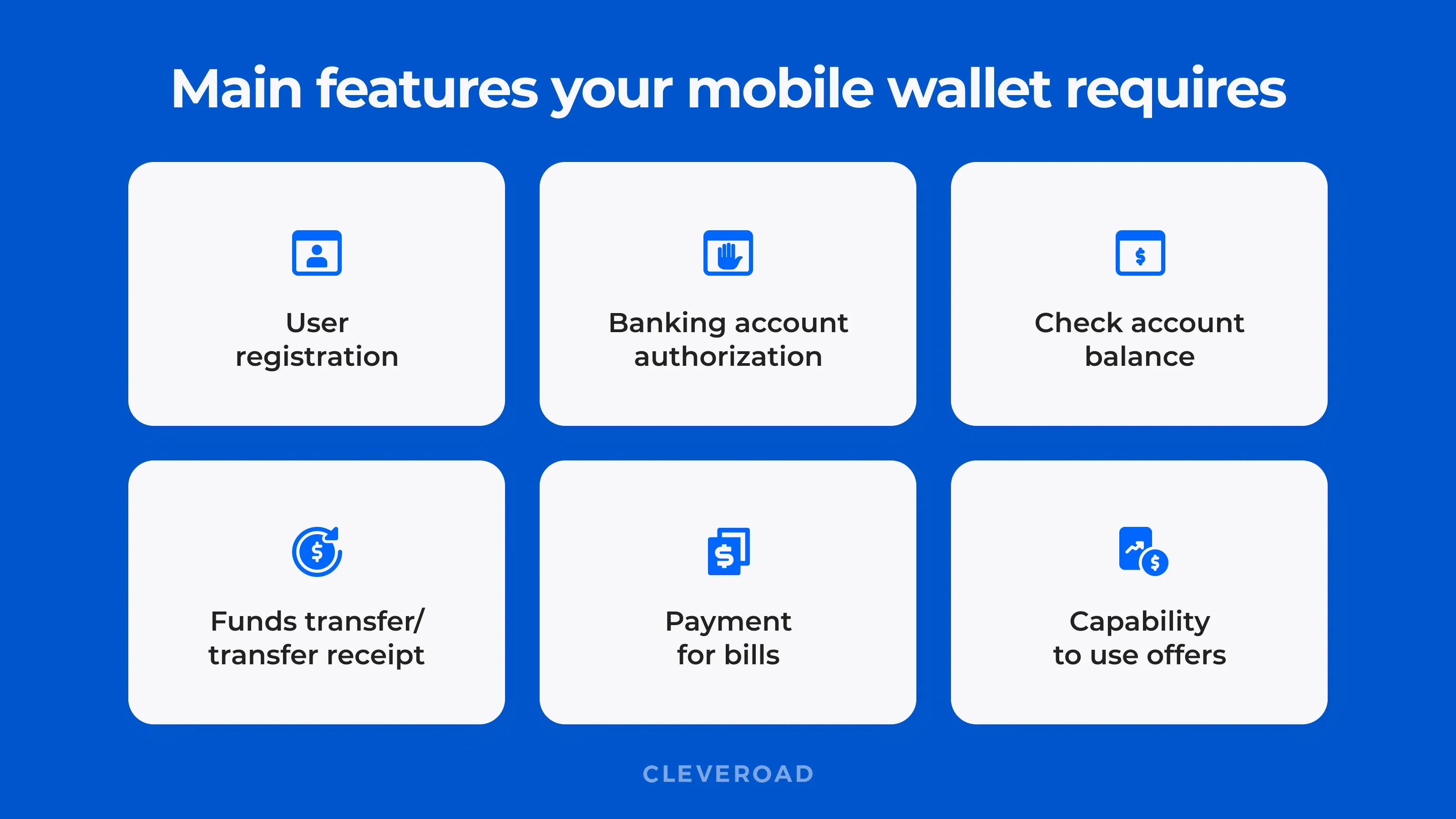

Features your mobile wallet requires first

If you decided to find out how to make e-wallet app, you will have to consider all basic features new app must contain to satisfy clients' demands.

- User registration;

- Banking account (or credit card) authorization;

- Opportunity to add and check account balance;

- Funds transfer and transfer receipt;

- Payment for bills;

- Opportunity to use offers (discount coupons, personal funds return).

Basic features for your mobile wallet

Additional features

Mobile wallet development as a full-fledged solution for your business can become a good way to arrange the connection with your clients and increase a database of loyal customers. But to enrich your app, you can add the following options in future to any types of digital wallets:

- Loyalty card;

- Loyalty reward offer;

- Loyalty card with criss-crossed advertising campaigns;

- Gift cards;

- Push-notifications;

- Geo-targeting will allow you to locate active geotags on the map. When the client clicks them, he will get the notification about some new campaigns;

- Exclusive offers;

- Membership cards/discounts etc.

Everything listed above can bring benefit to your business in the form of a large number of clients, their interest as well as useful experience.

So it is up to you to choose what mobile wallet you want and what you should undertake to create it. You just need to find out all benefits of e-wallet. Besides, you have to take into account that there many available and popular mobile wallets in the market, so it will be not easy to become the leader. Your future wallet app should have substantial advantages over other competitors.

Follow new trends and create Bitcoin wallet app. Read Bitcoin wallet app development: propers APIs to start with and right MVP model

Cleveroad Proficiency

Cleveroad is an expertized software development company with headquarters in Central Europe. We specialize in helping startups and businesses of all scales acquire cutting-edge technologies since 2011.

Our competence comprises delivering a wide range of IT-related services and custom-built tech solutions. They boost workflow optimization, solve business issues, and ensure competitive advantages.

Cleveroad helps startups, SMBs, and enterprises reach their business goals and realize their project ideas.

- 10+ years on the market

- 120+ in-house engineers

- 170+ successful projects

Start e-wallet app creation now

Tell our Business Analysts about yor project and begin its elaboration right away

If you decided to find out how to make e-wallet app, you will have to consider all basic features new app must contain to satisfy clients' demands.

- User registration

- Banking account (or credit card) authorization

- Opportunity to add and check account balance

- Funds transfer and transfer receipt

- Payment for bills

- Opportunity to use offers (discount coupons, personal funds return)

Users open the app and authorize using a PIN code, password, or a fingerprint scanner as an additional option. Then users choose card or banking account that was assigned to the app previously and plan to use this account for performing a current transaction. Then it is necessary to choose special offers or loyalty programs for clients to make use of. To achieve this goal, users should connect it to the payment terminal.

To create a digital wallet, you have to come up with an MVP feature list and conduct market analysis. Then, you can think about the additional features and the marketing campaign. Besides, don't forget about the security protocols. Vulnerabilities may lead to fraud, loss of finances, and reputation.

Security of mobile wallets depends on security protocols that engineers use during the development stage. Safe mobile wallets have following security measures:

- Point-to-point encryption

- Tokenization

- Password

A number of fields may need mobile wallets to simplify routine operations. Thus, e-wallet can be an excellent addition to e-commerce solution. It allows customers to store information about bargains and make payments in form of coupons and bonuses.

Financial establishments give users various cards like credit, debit cards, provide clients with services (for example, payment for public services with credit cards).

To develop your own e-wallet app, you have to come up with a precise feature list and clear vision of the final version of your product. Then, you have to conduct research and find a software development company that will take care of the development process.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

1 commentsThanks for sharing informative and valuable blog .This blog is more helpful . I got more information about mobile wallet app.